Digital sales registration

Is your business ready for the new requirements for digital cash registers?

The Danish Tax Agency has introduced new requirements for digital sales registration to combat the black economy and ensure that businesses pay the correct taxes and duties. If your company has not yet implemented digital sales registration, it is essential to act quickly to comply with the legislation, which comes into effect on January 1, 2024. At Shopbox, we have the solutions to make the transition smooth and hassle-free.

What is digital sales registration?

Digital sales registration (or digital cash register system) is where sales data is recorded and stored electronically. This can include information about products, customers, prices, staff, and transactions. By using digital tools to record sales, businesses can achieve greater accuracy and efficiency in their sales processes. Digital sales registration can also contribute to improved reporting, accounting, and sales data analysis, which can help businesses with strategy and growth.

Who needs to implement digital sales registration, and is my business covered by this law?

Since 2018, the Danish Tax Agency has conducted control visits at numerous retail and service businesses in Denmark and identified several errors in the registration of VAT and sales. Control visits continue and have cost thousands of Danish businesses tax assessments.

If your business has an annual turnover of over 50,000 DKK and less than 10 million DKK and is within the retail and service industry, you are covered by the law.

Which industries are subject to the digital sales registration requirements?

So far, the following four industries are subject to the new requirements from January 1, 2024:

- Cafes, pubs, nightclubs, etc.

- Pizzerias, grill bars, ice cream bars, etc.

- Grocers and convenience stores

- Restaurants

During control visits, the Danish Tax Agency can already require the business to switch to a digital sales registration system. In 2021, 215 out of 357 firms were required to change systems as many current systems do not meet the applicable requirements. You can read more about the new requirements here.

If you are not already using a digital cash register system and there are irregular sales registrations, the chance that the authorities will visit your business in the following control round is relatively high. Therefore, switching to a digital cash register system as soon as possible is essential! At Shopbox, we have the perfect solution for you.

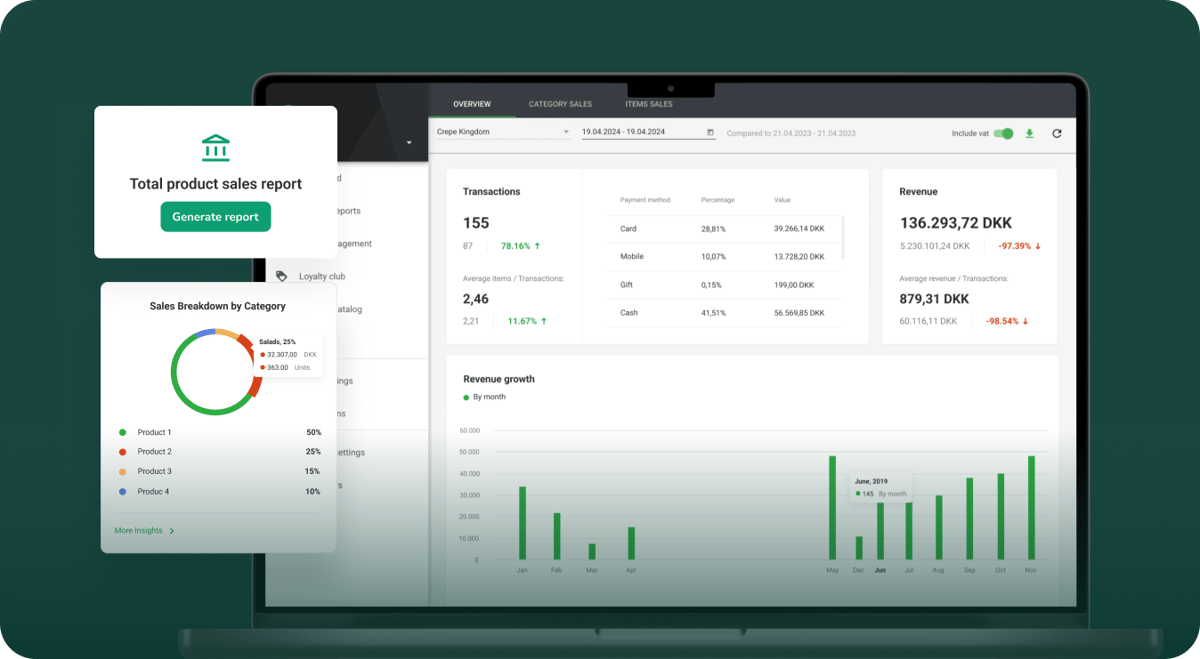

Digital cash register system from Shopbox - easy and flexible!

Our cloud-based cash register systems make it easy to meet the requirements for digital cash registers. The system is easy to use and can be customized to your business needs. It is also easy to integrate with other business applications, including MobilePay, Shopify, Wolt, Just Eat, Foodora, and many more. We make sure to tailor the best solution for your business and get everything working together—easy, secure, and in accordance with Danish legislation!

We have also implemented SAF-T reporting in our cash register systems, so you can be sure to comply with all legislative requirements. The report contains details of the company's financial transactions and will also be a legal requirement from January 1, 2024.

Contact us today for more information about our digital cash register systems and get started with the implementation. We will ensure a smooth transition to digital sales registration so you can focus on running your business with peace of mind.